How to Calculate Customer Acquisition Costs (CAC)

CAC, or customer acquisition cost, is a critical business indicator used by businesses worldwide to assess the resources required to attract new customers and maintain growth.

Traditionally, a company would have to engage in shotgun advertising and find ways to track consumers through the decision-making process. Many web-based businesses can now conduct highly targeted campaigns and track customers as they progress from interested leads to long-term loyal customers. The CAC indicator is employed in this climate by both corporations and investors.

If you want your company to grow while still making a profit, you need first to understand what CAC stands for, what it means, and how your team can calculate it.

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost is a measure that can assist you in determining the overall cost of sales and marketing required to bring in a new customer. It includes the following expenses:

- Advertising expenditures,

- Manufacturing costs,

- Inventory upkeep,

- Salaries,

- Commissions,

- Technical costs,

- Overheads,

- Creative costs, and

- Bonuses

Customer acquisition cost is a huge factor in deciding whether your start-up business has a sustainable business model – the lower it is, the sooner your company will be able to see a return on investment. CAC is frequently used in conjunction with the customer lifetime value (LTV) metric to assess the value created by a new customer. This considers whether your product is a one-time purchase, a purchase made every ten years or a weekly purchase. This adds another dimension to the CAC evaluation.

It’s critical to remember that costs primarily associated with customer success should not be considered when calculating customer acquisition costs. Although client success generates money for your company, the customer acquisition cost is all about determining your company’s potential to produce new revenue from sales and marketing initiatives. By including customer success costs, that measurement may become distorted, and you will not have an accurate picture of your business.

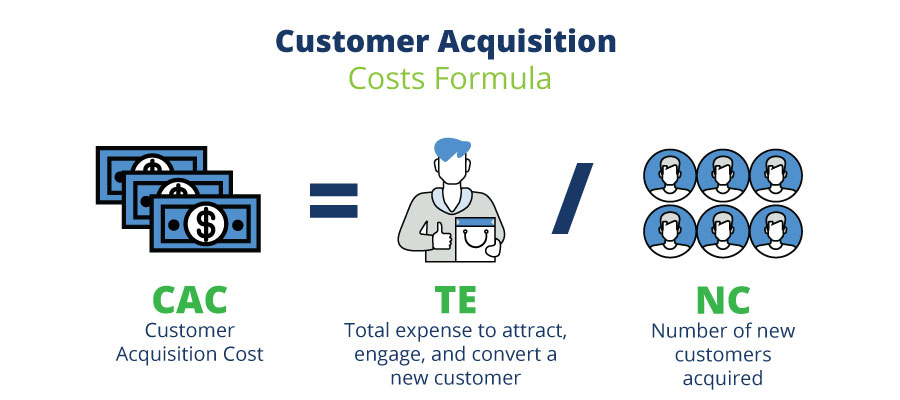

How to Calculate Customer Acquisition Cost

There are several methods for calculating CAC. A simple formula can be used to assess a certain campaign or plan for attracting new clients to your business. To calculate the customer acquisition cost (CAC), just divide all associated marketing costs (MC) and sales costs (SC) by the number of customers acquired (CA).

Where:

Sales and marketing expenses include advertising and marketing spend, commissions and bonuses paid, salaries of marketers and sales managers, and sales and marketing overhead costs incurred during the measurement period.

The number of new customers is the total number of consumers obtained during the measuring period.

You should also take into account the CAC and how it affects your profit margins. If the CAC is excessively high in relation to the product’s cost, mark-up, and other charges, you may end up losing money. As a result, what is a decent CAC for one company may not be suitable for another.

Depending on the nature of your business, you may want to factor in some of the following costs when calculating CAC:

- Cost of new customer sales support call centres as a whole (CC)

- Total cost of strategic partners paid per customer (SP)

- Total monthly spend on search engine optimisation (SEO)

- Total number of new clients gained in a year (NC)

Customer Retention Cost vs. Customer Acquisition Cost

What is the distinction between client acquisition and retention costs? Simply put, customer retention costs are the money you spend to keep your existing customers rather than the money you spend to bring in new business. When it comes to the cost of customer retention versus customer acquisition, many businesses place an overabundance of emphasis on acquisition. In fact, the cost of acquiring a new customer can be five to twenty-five times that of retaining an existing one, thus it often makes sense to prioritise preserving your present consumers.

How to Optimise Your Customer Acquisition Cost

You can ensure that your firm is as profitable as possible by minimising your customer acquisition costs. Pricing is quite important. Using a skimming pricing strategy, for example, can ensure that you’re gaining more cash upfront to recover your CAC. You should also take a lean strategy to marketing and sales, focusing on channels with proven returns rather than speculative approaches that may not result in many purchases.

- Optimise Your Sales and Marketing Funnel

Understand how many visits lead to leads, how many leads lead to opportunities, and how many opportunities lead to customers by quantifying each step of the process. The Balfour Method of the growth process, which assures appropriate mechanics in your channels, is the finest approach to do this.

- Increase Website Conversions

You want to make sure you’re getting the most out of your site since you don’t want to lose sales due to site flaws. Check that your calls-to-action are effective, that your website is mobile adaptable, that your landing pages are optimised, and that your message is clear and easy to grasp.

- Optimise Your Pricing Strategy

Remember that a large amount of CAC contributes to the recovery period, as well as your CAC ratio. As a result, if you optimise your pricing to gain cash upfront to recover your CAC, such as mandatory training, integration costs, and so on, you can ensure you begin making a profit as soon as possible.

- Introduce a Retargeting Strategy

Do visitors to your website frequently leave without making a purchase? Retargeting is a method of reminding people about your products or services after they’ve left your site or abandoned their online shopping basket. Running ad campaigns to display adverts for your items on other websites that your clients are likely to visit is one approach to accomplish this.Customers may abandon carts because they are not yet ready to make a purchase, or they become preoccupied and forget. On the other hand, a polite reminder can urge them back in the direction of your product. - Launch an Affiliate Program

Another option to cut costs is to set up an affiliate arrangement. Affiliates will do much of your marketing for you by promoting your product or service to their audiences in exchange for a percentage of sales. This has the ability to greatly increase your reach while relieving you of some of the real marketing labour. This solution is simple to set up, adaptable and bears no risk. It will also provide you with high-quality traffic at a reasonable cost.

Final Thoughts

Only by knowing how much it costs to acquire new consumers you can make smart business decisions and forecast how lucrative your company can be in the long run.

As you can see, calculating and monitoring your customer acquisition costs is critical. It makes measuring the efficacy of your marketing efforts, evaluating various acquisition strategies, and ensuring long-term profitability easy. Furthermore, doing so allows you to assess the impact of each strategy on your total CAC, profitability, and bottom line. So, take the time to determine your company’s customer acquisition expenses and evaluate how you can better use your resources.