How AI Can Help Small Businesses to Cope during an Economic Downturn

Recent Posts

COVID-19 has significant consequences for enterprises worldwide as they adjust to the ‘new normal’ of running a business remotely. As the country continues to suffer from an economic crisis, SMEs are wrestling with managing the cash flow consequences of the altered business environment.

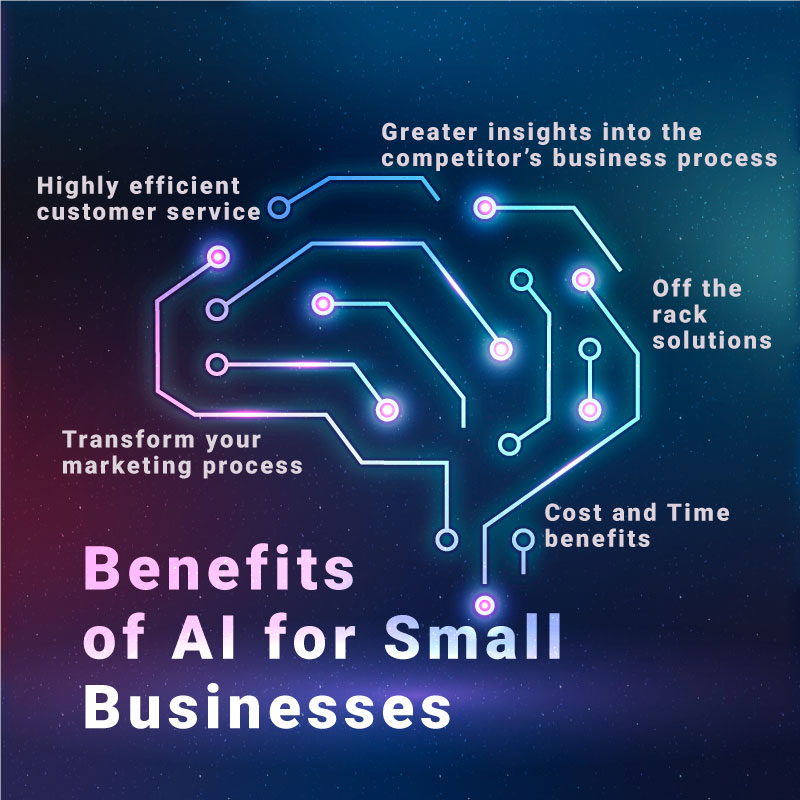

Many Australian and New Zealand businesses are already examining their operations to determine where savings and efficiency might be gained. Artificial intelligence (AI) and its subset, machine learning, may answer SMEs’ cash flow management problems. Instead of doing every activity manually, businesses are discovering the power of automating their systems. As a result, they achieve higher efficiencies, fewer errors, and, ultimately, more revenues.

Investing in a new program or system during an economic downturn may seem paradoxical; but, without the information and oversight that an automated program may provide, SMEs may struggle to gain a clear picture of where their money is being spent and saved.

What value does artificial intelligence provide to a business?

- Your data can be used by AI to understand your clients better.

- Over time, AI learns more about your customers.

- AI can notify you of potential dangers and abnormalities.

We have prepared a list of seven corporate tasks that are at risk, as well as the AI solutions that could help.

Product Quality Assurance

If you own or run a manufacturing company, the quality of your products is critical to maintaining your reputation. Manually monitoring and analysing each product as it goes through the manufacturing process, on the other hand, is time-consuming and costly in terms of payroll.

You, on the other hand, cannot afford not to do it. AI, it turns out, offers a practical solution to this problem. You can use AI to automate product scanning and evaluation. The software can detect defects in your product using machine learning and allow you to rectify them before they reach the buyer.

Scheduling Workers

Choosing who to schedule and when can be a major challenge for management. You waste resources when you schedule too many employees at once. However, if you don’t schedule enough, you risk running out of capacity, negatively impacting your customer’s experience.

AI can predict the optimal times to schedule different members of your team. This can be calculated by looking at past peak times and other criteria. It is conceivable for software to perform tasks at a scale that would be difficult for humans to complete in the same amount of time.

Document and Identity Verification

AI can help with identity and document verification. Consider a bank that needs to authenticate its customers for onboarding and compliance. This is frequently done by human checkers, who examine payslips or driver’s licences, which is a costly, inefficient process.

Instead, AI can be used to identify the type of ID document captured quickly, determine if the security features of the ID are present, perform face-matching – comparing the picture in the ID to the person in the selfie – and even help determine whether the person is physically present.

Digital account opening has been at the top of the list of technologies that organisations aim to add or replace for the past few years, but COVID-19 is driving this part of digital transformation to the front of the line.

Customer Appointments

Many businesses rely on customer appointments to survive. However, far too many companies fail to schedule them at the appropriate periods. This was a challenge even before the arrival of technology to help with scheduling.

With AI at its disposal, every business should take advantage of the capacity to schedule consumers automatically. You can program the software to learn the ideal hours for your staff and clients by entering predefined scheduling criteria.

Back-office Tasks

AI-powered cognitive assistants can perform back-office work. This involves arranging new payment cards, issuing refunds, and cancelling orders. When the cognitive assistant cannot handle a task because of its complexity, it may be effortlessly turned over to human agents to manage. This ensures that those team members’ time is spent solving the most difficult challenges and on value-added activities.

This procedure is known as robotic process automation (RPA) and is increasingly integrated with machine learning. It encompasses all types of back-office service operations, as long as they are structured tasks, such as automating insurance or banks’ claims processes.

Boosting Cybersecurity

Increased digital information – from customers and organisations – needs enhanced digital security. Cybersecurity AI analyses activity patterns on a company’s software, apps, and stored data. AI can recognise relevant and acceptable things by analysing what employees and consumers do with digital tools and how they do it – links, email messages, information inputs, and job time ranges. If something deviates from normal patterns (for example, an employee clicking an unknown link in an email), AI reacts fast to fix or eradicate the threat.

Malicious programs are created using their own AI-guided programs, therefore investing in strong cybersecurity is a sensible method to preserve business sustainability and customer trust.

Marketing

You can have the best company on the planet. However, if you do not advertise it appropriately, your buyers will not have the correct perspective. They may not even be aware that you exist at times.

By automatically recommending marketing techniques, AI can help with the problem of obscurity. It can detect behavioural patterns that led consumers to your page and induced them to make a purchase. Then all you have to do is repeat and grow the process.

For example, if a company employs customer relationship management (CRM) software that incorporates AI, it will have a more convenient organisation for mass communication. AI CRM can ‘hear’ clients in ways that humans cannot, collecting and evaluating data from multiple channels (e.g., email newsletters and social media).

Companies such as Scuba and Opentopic are using artificial intelligence to automate key insights such as behavioural and predictive analytics, allowing businesses of all sizes to create highly personalised customer and user experiences.

It is not just for the largest corporations with unlimited expenditures for artificial intelligence. There are numerous applications that small businesses can include in their daily operations. This allows you to decrease errors, enhance productivity, and eventually make more profits for your company, which any organisation should strive for.

Available Now

For a good reason, artificial intelligence is gaining popularity. We’ve interwoven AI into our lives, from movie recommendations to voice control, and your consumers are no exception. If they haven’t already, they’ll be expecting your company to use this technology shortly.

Fortunately, there are a variety of options available to assist you in running your small business faster and wiser than ever before.

- Using AI for CRMs, you may gain fresh insights from the data you already have.

- Sales may be coached using artificial intelligence insights.

- Use chatbots to handle typical customer support inquiries.

- Use a chatbot to answer frequently requested HR questions.

Final Thoughts

Whatever path you take, keep in mind that artificial intelligence is not a one-size-fits-all solution. Although many technologies accessible to small businesses today include a wide range of comprehensive services with purchase, your initial installations will be imperfect. You’ll still need to roll up your sleeves and understand the technology, but the return will be well worth the effort.