Performing a Small Business Risk Analysis: Steps to Get Started

Recent Posts

A Risk Analysis refers to the process of recognising potential issues that could negatively impact the business and identifying strategies to mitigate those risks. External and internal factors can contribute to the risks, which are both systemic (i.e., inherent to the entire market) and nonsystematic by design. It is critical to recognise that risks exist regardless of the type or size of the business. Furthermore, the threats that companies face can have a broad and deep effect on their operations, as well as affect their long-term viability. That is why it is important to identify all possible risks so that mitigation strategies can be put in place to address these. Risk management is regarded as an integral part of any effective business strategy for new and startup companies.

Major risks faced by the businesses

In order to develop a mitigation and risk response strategy, business owners should first identify the key risks they might face A significant number of small business owners face the four major risks mentioned below, which could prevent them from reaching their objectives. For more details, check out our checklist of risk factors to avoid when starting a company.

- Strategic Risk – is associated directly with a company’s strategy and can prevent a business from achieving its goals. Poor strategic planning or erroneous execution are the major culprits of strategic risk. The strategy to avoid or mitigate this risk is to resort to a specialist, such as a small business accountant that can assist you with a comprehensive and well-thought-out business strategy.

- Financial risk – refers to the potential for a sudden financial loss, and represent the biggest risk that is faced by many small organizations. Cash flow is one of the biggest concerns at the beginning. It is essential to take into consideration all the aspects, including where money will come from to maintain operations, pay employees, and invest in market penetration and growth. Some industries require a large upfront investment with a large amount of time not seeing a return. Careful preparation and planning, as well as support from third parties, can help you mitigate this risk. Our tips to sales forecasting can help you predict and plan for such issues.

- Compliance Risk – appears when business do not comply with all the necessary laws and regulations. Sometimes compliance risk occurs when business expands, and business owners forget to keep track of the compliance measures. Finding an accountant with suitable compliance expertise can ensure the safety of your business.

- Reputation risk – is one of the most commonly overlooked risks. For a small business to grow, company’s reputation is key. Reputational damage can lead to loss of revenue, loss of business partners and loss of clients along with staffing issues. With the constantly increasing use of social media and technology, it has become both easier and harder to manage your reputation. Hiring the right accounting firm, employees, directors and a good marketing agency will help you minimise this risk. Additionally, we recommend to encourage feedback, both positive and negative, and always show gratitude and empathy in responding.

Risk Analysis Process

Risk analysis process for your company should be dynamic and interactive process rather than a static and require continuous update and analysis of information with all risk elements due for review in a specified period.

A risk management process needs to cover the following elements:

- Identify Your Company’s Potential Risks

The first and most important step of performing risk analysis is to identify and describe potential risks that are related to your business. You can start with a brainstorming session with your team members and define categories for the risks that are relevant to your business, such as Governance & Ethics, Competition, Innovation, Business, Economy, Reputation, Interest Rate, etc. Once you have identified all the risks, they should be categorically placed in a document known as the Risk Register/Library.

- Determine the Likelihood of the Risk

Use one of the following schemes to describe the chances that a risk will occur:

- Probability of occurrence: You can express the likelihood that a risk will occur as probability. Probability is a number between 0 and 1, with 0.0 signifying that a situation will never happen, and 1.0 signifying that it will always occur. (You may also express probability as a percentage, with 100 percent meaning the situation will always occur.)

- Category ranking: Classify risks into categories that represent their likelihood. You may use high, medium, and low, or always, often, sometimes, rarely, and never.

- Ordinal ranking: Order the risks so the first is the most likely to occur, the second is the next most likely, and so on.

- Assess the Degree of Impact or Significance

The results of the previous step are then used to prioritise risks to establish a critical importance rating from most to least critical, with 1 being negligible and 5 being catastrophic (How much of an effect will this risk have if it happened?). Ranking risks in terms of their criticality or impact provides insights on where resources may be needed to manage or mitigate the realisation of high probability/high consequence risk events.

- Determine the Nature of the Risk

Systematic risk is inherent to the entire market, where unsystematic risk is unique to a specific company or industry. A new competitor in the market with the ability to take substantial market share from the business invested in is an example of an unsystematic risk as well as a regulatory change (which could drive down company sales), a shift in management, and/or a product recall.

- Develop Mitigation Strategy

When risks are determined, some risks are better not to avoid or accept. In this instance, you need to explore the ways of risk mitigation. The mechanisms and strategies of risk management are referred to as risk reduction. When you identify risk and its probability, you can allocate resources for management.

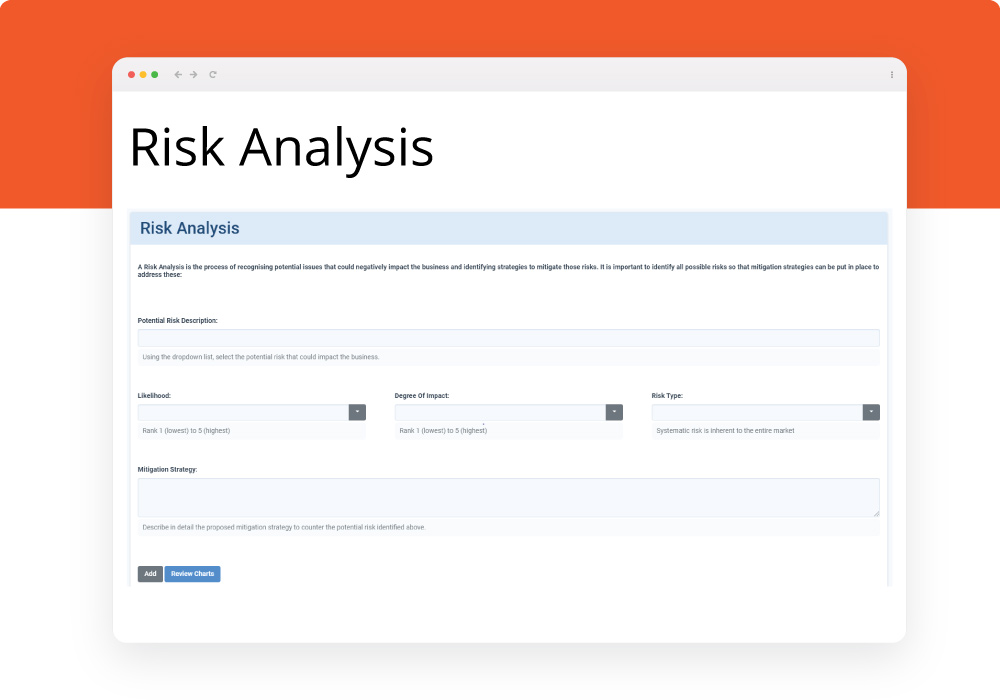

When you are at the beginning of setting up your business, one of the best ways to help recognise, define and monitor risks is to have structure tools within your organisation. Planium Pro software covers ‘Risk Analysis’ that can help you to set up controls and procedures and have the whole picture of the risk exposure with real-time dashboards.